Rebate U/S 87a For Ay 2024-21. Individuals who are having a taxable annual income of up to rs 5 lakh will get full tax rebate and if the taxpayers fully utilize the deductions which are permitted under section 80c of. Updated 2 feb 2023, 09:35 am.

/ premium luxury platinum 4wd. Income tax rebate u/s 87a:

Rebate U/S 87a For Ay 2024-21 Images References :

Source: www.youtube.com

Source: www.youtube.com

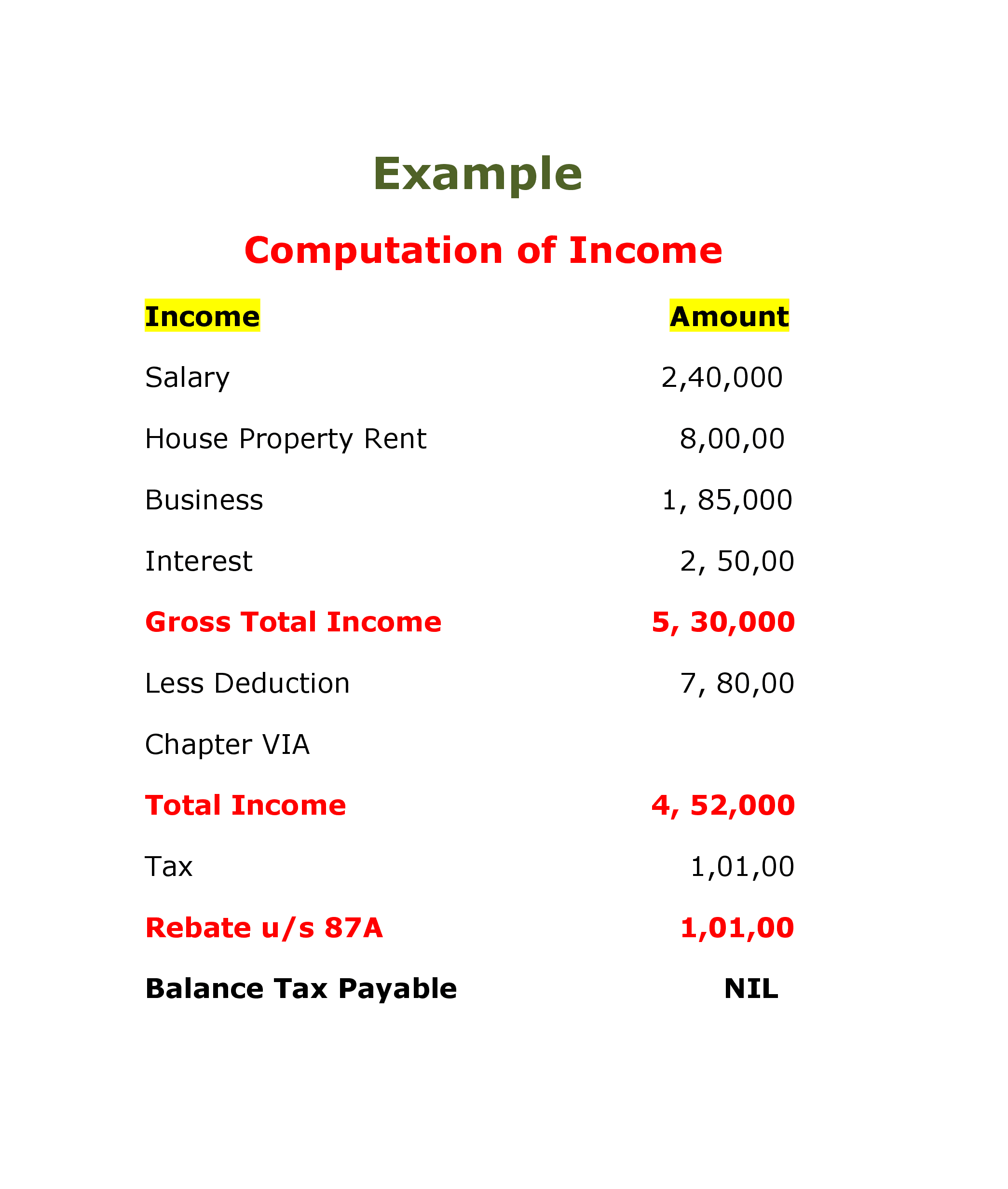

Section 87A rebate in old & new tax regime 2425 87A Rebate New, Income tax rebate u/s 87a:

Source: www.flickr.com

Source: www.flickr.com

Rebateus87Ainfographic Tax Rebate Under Section … Flickr, / premium luxury platinum 4wd.

Source: arthikdisha.com

Source: arthikdisha.com

Tax Rebate U/S 87A for AY 202425 & FY 202324, No tax rebate is being given if you have sold mutual fund or shares and earned short term capital gains.

Source: www.youtube.com

Source: www.youtube.com

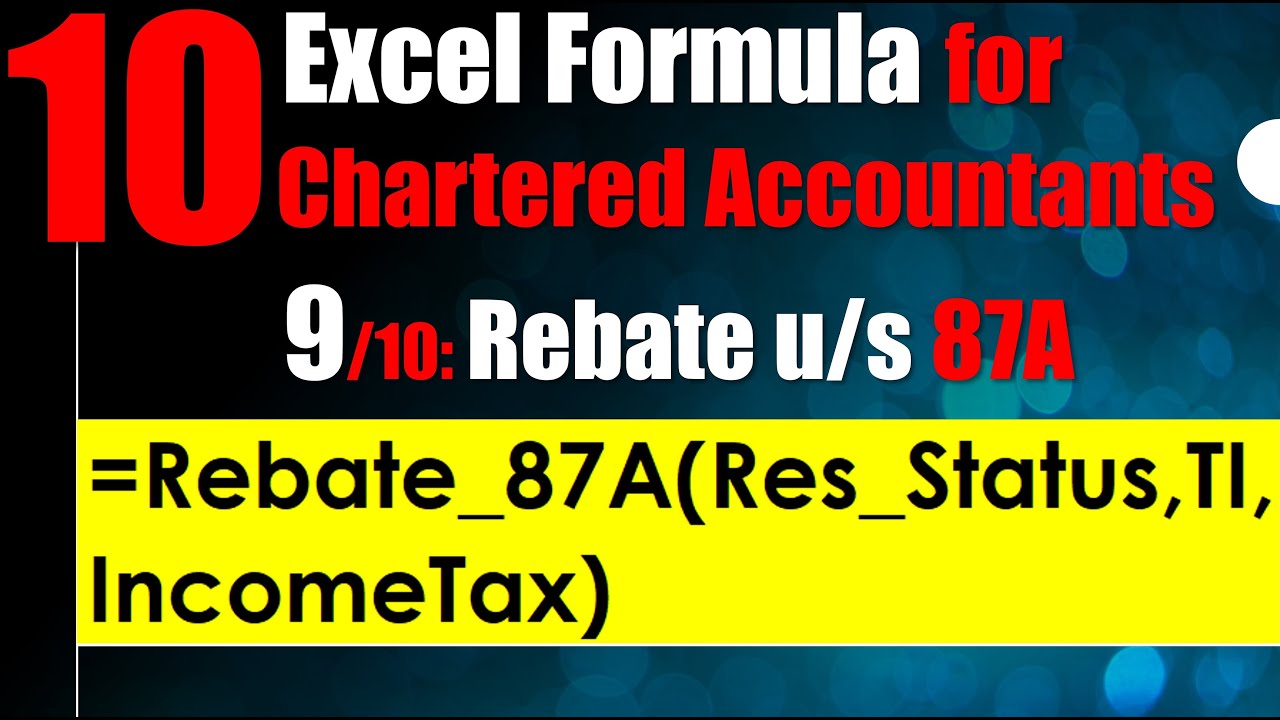

Excel Formula to calculation tax rebate u/s 87A YouTube, Under section 87a, a taxpayer is given tax rebate of ₹ 25,000 in both new and old tax regime.

Source: www.taxguidenilesh.com

Source: www.taxguidenilesh.com

87A Rebate का नया नियम आयकर Rebate u/s 87A कैसे प्राप्त करे? How to, Used 2024 cadillac escalade platinum.

Source: www.wintwealth.com

Source: www.wintwealth.com

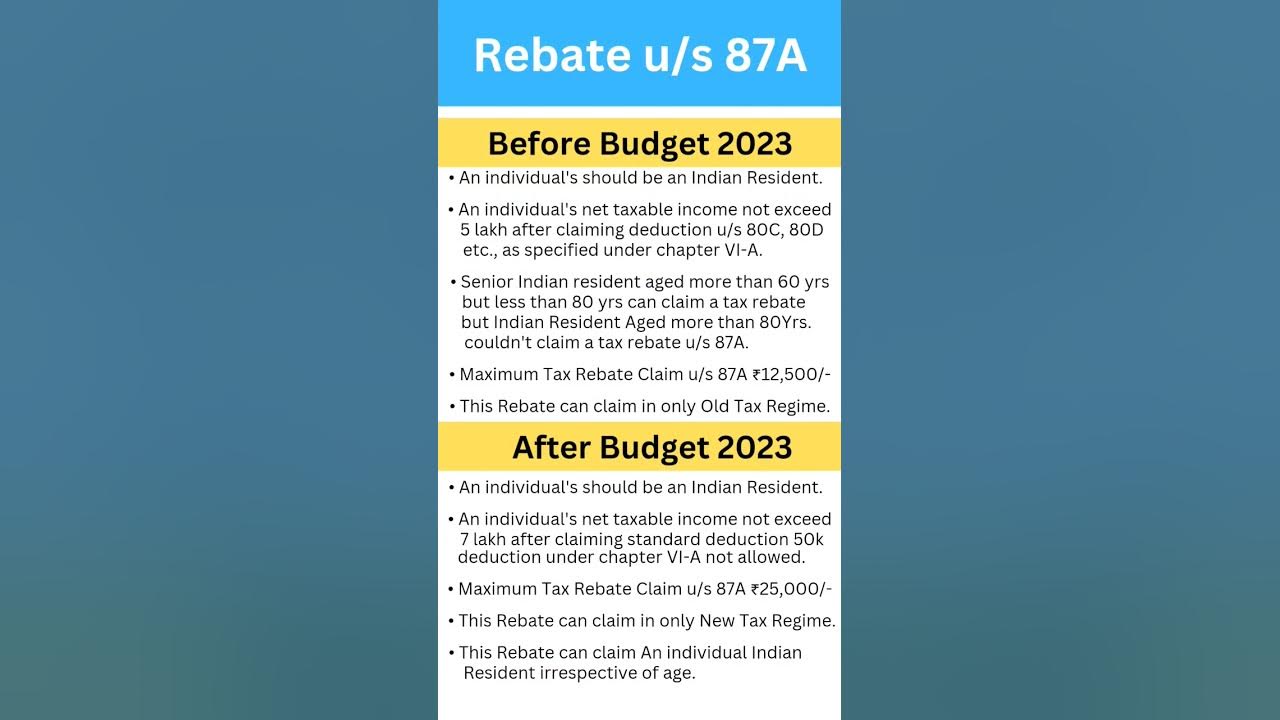

Tax Rebate Under Section 87A, To make the new tax regime more attractive, the rebate under section 87a has been hiked to rs 25,000 for taxable income up to rs 7 lakh.

Source: greatsenioryears.com

Source: greatsenioryears.com

Guide Rebate U/S 87A for Senior Citizens Greatsenioryears, Used 2024 cadillac escalade platinum.

Source: www.youtube.com

Source: www.youtube.com

Rebate under 87a of Tax for 202324 with Budget 2023 Changes, To make the new tax regime more attractive, the rebate under section 87a has been hiked to rs 25,000 for taxable income up to rs 7 lakh.

Source: sandiewgalina.pages.dev

Source: sandiewgalina.pages.dev

Rebate Under Section 87a For Ay 202424 Tonye Wilone, Individuals who are having a taxable annual income of up to rs 5 lakh will get full tax rebate and if the taxpayers fully utilize the deductions which are permitted under section 80c of.

Source: www.youtube.com

Source: www.youtube.com

Rebate U/S 87A Limit Before Budget 2023 & After Budget 2023 gst , As per current income tax slab rates, a resident indian with individual total.

Posted in 2024